Finned tube industry will usher in a golden period of development

Chinas Finned Tube Industry Overview

Chinas finned tube industry is poised for significant growth as energy efficiency requirements increase across industrial sectors. Finned tubes, serving as critical heat transfer components in various thermal systems, play a vital role in enhancing energy utilization efficiency.

Market Insight: The finned tube market in China reached approximately ¥500 billion in 2010 and is projected to grow at a CAGR of 7.2% from 2022 to 2028, driven by increasing demand from energy-intensive industries and environmental regulations.

Finned tubes function as energy-saving devices that facilitate heat transfer between fluids at different temperatures. These components transfer thermal energy from higher temperature fluids to lower temperature fluids, enabling process temperature requirements while improving energy efficiency. The finned tube industry spans nearly 30 sectors including HVAC, pressure vessels, and water treatment equipment, forming a comprehensive industrial chain.

Key Industry Drivers

Chinas "Dual Carbon" goals (carbon peak by 2030, carbon neutrality by 2060) have accelerated industrial energy efficiency mandates, directly boosting demand for high-performance finned tubes in energy-intensive sectors.

The transition from labor-intensive to technology-intensive manufacturing requires advanced thermal management solutions, creating new opportunities for specialized finned tube applications.

Chinese finned tube manufacturers are increasingly competitive in international markets, particularly in Southeast Asia, Middle East, and Africa where industrialization is accelerating.

Chinas Finned Tube Industry Market Size by Industry Segment (2010)

Market Distribution (Billion CNY)

The petrochemical sector remains the largest market for finned tubes, accounting for ¥150 billion in 2010. Power metallurgy followed with ¥80 billion, while shipbuilding and machinery industries each represented approximately ¥40 billion markets. Emerging sectors including aerospace, semiconductor manufacturing, nuclear power, and renewable energy applications accounted for approximately ¥13 billion.

Market Segment Evolution (2010-2023)

While traditional industries remain dominant, their relative share has decreased as emerging sectors have grown more rapidly. The renewable energy sector has shown the fastest growth at 12.5% CAGR since 2015, driven by solar thermal and geothermal applications. The semiconductor sector follows closely at 11.2% CAGR, requiring ultra-precise temperature control in fabrication processes.

Emerging Opportunity: Data center cooling applications represent a new growth frontier, with the market for finned tubes in this segment expected to reach ¥25 billion by 2025, growing at 18% annually due to increasing server densities and thermal management requirements.

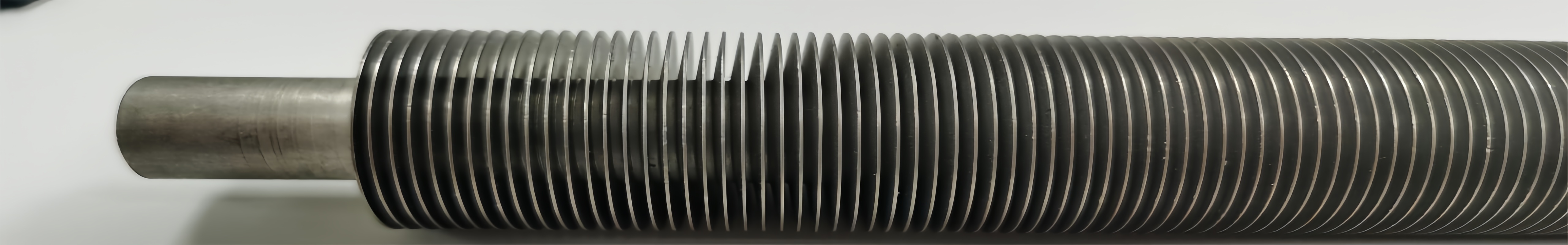

China Finned Tube Types & Technical Specifications

| Type | Heat Transfer Efficiency | Pressure Resistance | Corrosion Resistance | Typical Applications | Cost Index |

|---|---|---|---|---|---|

| Extruded Finned Tubes | High | High | Medium | Boilers, Heaters | High |

| Welded Finned Tubes | High | Very High | High | High-pressure Systems | Medium-High |

| G-Finned Tubes | Medium | Medium | Medium | Air Coolers | Low-Medium |

| L-Finned Tubes | Medium-High | Medium | Medium | Heat Exchangers | Medium |

| Embedded Finned Tubes | High | High | High | Corrosive Environments | High |

As energy-saving technologies advance, the variety of finned tube types continues to expand. Each type offers distinct advantages depending on application requirements, with extruded and welded finned tubes typically providing the highest heat transfer efficiency for demanding industrial applications.

Emerging Technology Trends

3D printing enables complex fin geometries that were previously impossible, improving heat transfer efficiency by 15-30% in experimental applications.

Graphene and ceramic nano-coatings enhance corrosion resistance and thermal conductivity, extending service life in harsh environments by 40-60%.

Integrated sensors and IoT connectivity enable real-time performance monitoring, predictive maintenance, and efficiency optimization of finned tube systems.

Energy Efficiency & Waste Heat Recovery

Industrial sectors account for the largest share of Chinas energy consumption, with significant potential for efficiency improvements through advanced heat exchange technologies.

Over 50% of industrial energy is currently lost as waste heat. Finned tube heat exchangers can recover 30-60% of this energy, significantly reducing primary fuel consumption.

Industrial boilers consume approximately one-third of Chinas total energy. Finned tube applications can improve thermal efficiency by 15-25% in these systems.

China ranks among the world leaders in energy production, but its energy output per unit remains significantly lower than many developed countries, indicating substantial potential for energy conservation. Industrial boilers and furnaces represent primary targets for efficiency improvements, as they typically operate with low thermal efficiency and high exhaust temperatures.

Waste heat recovery has emerged as a critical energy conservation strategy, with finned tube heat exchangers demonstrating exceptional performance in this application. These systems can effectively capture and reuse thermal energy that would otherwise be discharged to the atmosphere, reducing both fuel consumption and environmental impact.

Case Study - Steel Plant Retrofit: A major steel manufacturer in Hebei Province installed advanced finned tube heat exchangers to recover waste heat from blast furnace exhaust gases. The ¥85 million investment achieved annual energy savings of ¥32 million with a payback period of 2.7 years, while reducing CO₂ emissions by 125,000 tons annually.

Regional Industry Analysis

Chinas finned tube industry exhibits distinct regional characteristics based on industrial concentration, resource availability, and policy support.

Eastern Coastal Region

Market Share: 45% of national production

Key Provinces: Jiangsu, Zhejiang, Shandong

Characteristics: Advanced manufacturing, strong export orientation, highest technology adoption rate, serving petrochemical and shipbuilding industries.

Northeast Industrial Belt

Market Share: 25% of national production

Key Provinces: Liaoning, Heilongjiang

Characteristics: Traditional heavy industry base, strong in power generation and metallurgy applications, undergoing industrial transformation.

Central & Western Regions

Market Share: 30% of national production

Key Provinces: Henan, Sichuan, Shanxi

Characteristics: Growing manufacturing hubs, benefiting from industrial relocation policies, strong in mining and chemical applications.

The eastern coastal region leads in high-value, technologically advanced products, while central and western regions are gaining market share through competitive pricing and proximity to emerging industrial clusters.

Major Manufacturers & Competitive Landscape

The Chinese finned tube market features a mix of state-owned enterprises, large private manufacturers, and specialized SMEs, with increasing consolidation in recent years.

| Company Type | Market Share | Key Strengths | Primary Markets | Technology Level |

|---|---|---|---|---|

| State-Owned Enterprises | 35% | Large-scale production, government contracts, R&D funding | Power generation, Petrochemicals | High |

| Large Private Manufacturers | 40% | Market responsiveness, cost efficiency, export capability | General industry, HVAC, International | Medium-High |

| Specialized SMEs | 20% | Niche expertise, custom solutions, rapid innovation | Emerging sectors, High-tech applications | Variable |

| Foreign Joint Ventures | 5% | Advanced technology, quality standards, global networks | Premium segments, Multinational clients | Very High |

Industry Challenges: Despite growth, the industry faces several challenges including raw material price volatility (particularly nickel and copper), environmental compliance costs, skilled labor shortages, and intensifying international competition particularly from German and Japanese manufacturers in premium segments.

Chinas Finned Tube Industry Market Forecast (2017-2028)

| Year | Market Size (Billion CNY) | Growth Rate | Key Drivers |

|---|---|---|---|

| 2017 | 620 | 6.8% | Environmental Regulations |

| 2018 | 662 | 6.8% | Industrial Modernization |

| 2019 | 707 | 6.8% | Energy Efficiency Standards |

| 2020 | 728 | 3.0% | COVID-19 Impact |

| 2021 | 785 | 7.8% | Post-pandemic Recovery |

| 2022 | 840 | 7.0% | Renewable Energy Expansion |

| 2023 | 900 | 7.1% | Carbon Neutrality Initiatives |

| 2024 | 965 | 7.2% | Advanced Manufacturing |

| 2025 | 1035 | 7.3% | Industrial Digitalization |

| 2026 | 1110 | 7.2% | Waste Heat Recovery Mandates |

| 2027 | 1190 | 7.2% | New Energy Applications |

| 2028 | 1275 | 7.1% | Sustainable Development Goals |

The analysis examines production, consumption, and trade patterns in Chinas finned tube market, highlighting key domestic and international manufacturers. Critical performance metrics including sales volume, revenue, pricing, and market share are evaluated for major market participants.

Export Market Dynamics

China has emerged as the worlds largest exporter of finned tubes, accounting for approximately 35% of global exports in 2022. Key export destinations include:

Rapid industrialization and infrastructure development drive demand, particularly in Vietnam, Indonesia, and Thailand.

Oil and gas industry applications dominate, with Saudi Arabia, UAE, and Qatar as major importers.

Growing power generation and mining sectors create opportunities, led by South Africa, Nigeria, and Egypt.

Future Growth Opportunities

The finned tube industry is evolving beyond traditional applications, with several high-growth opportunities emerging in next-generation technologies.

Hydrogen Economy

Finned tubes are critical for hydrogen liquefaction, storage, and fuel cell cooling systems. The market for hydrogen-related applications is projected to reach ¥45 billion by 2030.

Electric Vehicle Thermal Management

Battery cooling and heat pump systems in EVs require compact, high-efficiency finned tubes, creating a new market segment growing at 22% annually.

Carbon Capture Utilization & Storage

CCUS systems require specialized heat exchangers for CO₂ capture and processing, representing a potential ¥30 billion market by 2035.

Advanced Nuclear Power

Small modular reactors and Generation IV nuclear systems need highly reliable finned tubes for safety systems and heat transfer applications.

Strategic Imperative: Success in these emerging markets requires substantial R&D investment, partnerships with technology developers, and adaptation to new regulatory and performance standards specific to each application domain.

Chinas Finned Tube Industry Outlook

Chinas finned tube industry stands at a pivotal moment, with growing emphasis on energy efficiency and environmental protection driving market expansion. As industrial sectors increasingly prioritize thermal management and waste heat recovery, demand for advanced finned tube solutions is expected to accelerate. The industrys future growth will be closely tied to technological innovation, particularly in materials science and manufacturing processes that enhance heat transfer efficiency and durability.

Manufacturers who invest in R&D and develop specialized solutions for emerging applications in renewable energy, electric vehicles, and advanced electronics will likely capture significant market share in the coming years. With Chinas commitment to carbon neutrality by 2060, the finned tube industry is well-positioned to contribute substantially to the nations energy conservation goals.

Strategic Recommendations for Industry Stakeholders

Diversify into high-growth segments like hydrogen and EV thermal management, invest in digital manufacturing technologies, and develop circular economy capabilities for material recovery and remanufacturing.

Focus on companies with strong IP portfolios in additive manufacturing and nano-coatings, regional leaders with export capabilities, and firms positioned in emerging application ecosystems.

Develop specialized training programs for advanced manufacturing skills, create innovation clusters linking research institutions with manufacturers, and establish testing and certification centers for new applications.