Chinas heat exchanger industry is undergoing a transformative phase, driven by energy efficiency policies, technological advancements, and burgeoning applications in emerging sectors. As a core component in industrial energy systems, heat exchangers are evolving toward higher performance, intelligence, and sustainability.

Market Growth Drivers and Scale Expansion

The Chinese heat exchanger market has shown remarkable resilience and growth potential in recent years, fueled by industrial expansion and technological innovation. Key factors driving this growth include:

Market Expansion

Microchannel heat exchanger market reached RMB 2.1 billion in 2024, growing at 16.67% YoY.

Overall Market Size

Projected to expand from RMB 86.89B in 2022 to RMB 99.21B by 2026, with 3.4% CAGR.

High-Growth Segments

Wound-tube heat exchangers expected to grow at 18.5% CAGR from 2022 to 2026.

- Automotive Boom: 2025 saw 10.17 million vehicles produced in China (+12.91% YoY), boosting demand for compact, lightweight heat exchangers.

- Energy Transition: Policies like the Montreal Protocol and carbon neutrality goals are accelerating adoption of eco-friendly refrigerants.

- Industrial Expansion: Growth in petrochemical, power generation, and HVAC sectors continues to drive demand for efficient heat transfer solutions.

China Heat Exchanger Market Growth (2022-2026)

China Heat Exchanger Market Key Growth Segments

Microchannel: 16.67% YoY

Plate Heat Exchangers: 8.2% CAGR

Technology Evolution and Innovation Frontiers

The industry is witnessing significant technological breakthroughs that are reshaping product design and manufacturing processes:

Materials & Manufacturing

- Advanced Materials: Titanium alloys, graphene coatings, and ceramic composites enhance corrosion resistance and thermal conductivity. Graphite heat exchangers are gaining traction in chemical processing applications.

- Smart Production: Adoption of 3D printing and laser welding enables complex geometries, reducing material waste by 15-20% and improving production efficiency by 30%.

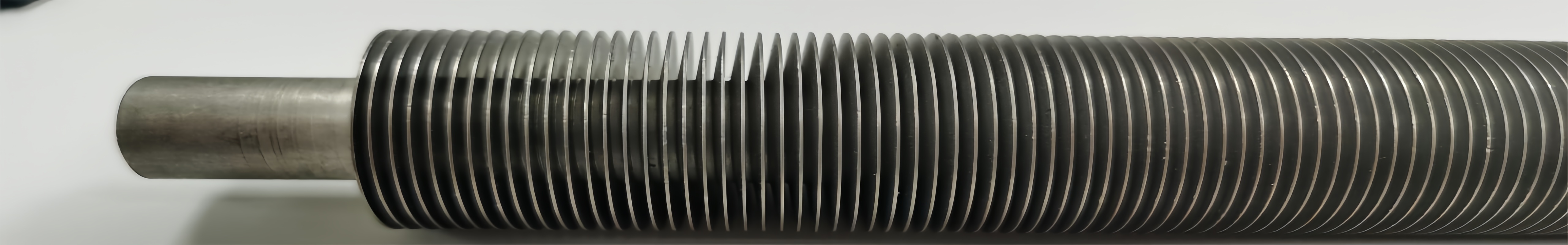

- Surface Engineering: Nano-coatings and enhanced fin designs are improving heat transfer efficiency by up to 25% in some applications.

Intelligent Integration

- IoT and AI: Next-generation heat exchangers incorporate sensors for real-time monitoring, predictive maintenance, and adaptive temperature control, reducing energy consumption by 15–30%.

- Digital Twins: Virtual modeling of heat exchange systems enables optimization before physical implementation, reducing design iterations by 40%.

Competitive Landscape and Leading Players

Chinas heat exchanger market features a dynamic competitive environment with a mix of established leaders and emerging innovators:

| Company | Revenue Growth (YoY) | Net Profit Growth (YoY) | Competitive Edge |

|---|---|---|---|

| Sanhua Intelligent Controls | +19.10% | +39.47% | Global microchannel leader (45% market share) |

| Kangsheng Co. | +28.91% | +434.10% | Automotive-focused innovations |

| DunAn Environment | Not disclosed | Not disclosed | Industrial refrigeration systems |

| Lanzhou LS Heavy Equipment | +12.4% | +22.7% | Large-scale heat exchangers for power plants |

The competitive landscape is characterized by:

- Market Consolidation: Leading players are acquiring smaller specialized manufacturers to expand product portfolios

- International Competition: Global giants like Alfa Laval and GEA face increasing pressure from domestic players in high-end segments

- Specialization: Companies are focusing on niche applications to differentiate their offerings

Emerging Application Scenarios

Heat exchangers are finding new applications in rapidly growing sectors:

| Sector | Key Driver | Heat Exchanger Type | Growth Potential |

|---|---|---|---|

| NEV Thermal Systems | EV sales surge; battery energy density rise | Microchannel, plate-type | High |

| Semiconductor Manufacturing | UHP requirements for chip fabrication | Ultra-high purity graphite units | Very High |

| Green Hydrogen | Fuel cell adoption | Corrosion-resistant plate designs | High |

| Data Centers | Liquid cooling for high-density servers | Compact, high-efficiency designs | Medium-High |

| Waste Heat Recovery | Energy efficiency regulations | Large-scale plate heat exchangers | Medium |

EV Thermal Management

Critical for battery performance and longevity, representing the fastest-growing application segment.

Semiconductor Manufacturing

Demand for ultra-pure heat exchangers is surging with chip fabrication expansion.

Green Hydrogen

Requires specialized corrosion-resistant designs for electrolysis processes.

Challenges and Future Directions

Despite strong growth prospects, the industry faces several challenges:

- Technical Hurdles: Fouling, corrosion, and reliability under extreme conditions remain problematic, especially in harsh industrial environments.

- Cost Pressures: Advanced materials like titanium and specialized alloys require higher upfront investment, limiting adoption in price-sensitive markets.

- Supply Chain Constraints: Specialized components and materials face supply chain disruptions and long lead times.

Strategic Shifts

Localization

Domestic R&D focuses on breaking foreign monopolies in high-end markets like UHP heat exchangers.

Customization

Deep collaboration with end-users to develop application-specific solutions.

Sustainability

Design for circular economy principles and reduced environmental impact.

The industry is also moving toward servitization models, where manufacturers offer heat exchange as a service rather than just selling equipment.

Toward an Intelligent, Sustainable Ecosystem

Chinas heat exchanger industry is transitioning from volume-driven to value-centric growth, underpinned by:

- Technology-led upgrades in materials, manufacturing processes, and digital integration

- Export expansion as domestic players increase their global footprint

- Policy tailwinds supporting green manufacturing and energy efficiency

- Vertical integration along the supply chain to capture more value

Companies that prioritize R&D in smart, eco-friendly solutions—particularly for NEVs, renewables, and semiconductors—will lead the next phase of growth. With strong industrial synergies and innovation momentum, China is poised to become a global hub for high-efficiency heat exchange solutions.

The future will see increased convergence between heat exchange technology and digital systems, creating intelligent thermal management ecosystems that optimize performance across industrial processes.